Introduction

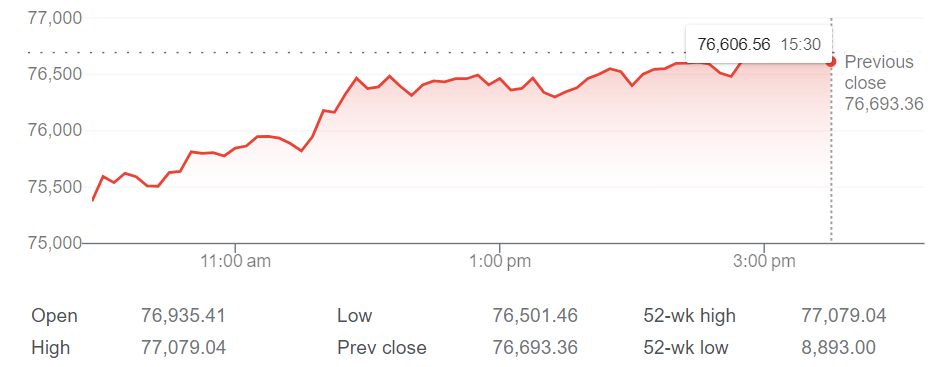

The Bombay Stock Exchange (BSE) Sensex, India’s premier stock market index, saw significant activity on June 10, 2024. This blog post provides a comprehensive analysis of the day’s market movements, major contributors, and key takeaways.

sensex today Market Overview

On June 10, 2024, the Sensex opened at 76,500.78 points, showing strong market sentiment from the start. By the end of the trading session, the index closed at 76,795.31, marking a substantial gain of 294.53 points or 0.39%. This positive movement highlights the ongoing confidence in the Indian equity market.

Key Performers

Top Gainers:

- Reliance Industries: Continued its upward trajectory with a significant gain due to robust quarterly earnings and strategic expansions.

- HDFC Bank: Benefited from positive market sentiment following strong financial performance and growth projections.

- Tata Consultancy Services (TCS): Saw gains driven by consistent contract wins and favorable market conditions.

Top Losers:

- The top losers’ list was relatively limited, indicating broad-based market strength. However, some sectors experienced profit-taking after recent rallies.

Sectoral Performance

The market witnessed varied performances across different sectors:

- Technology: Led by TCS, the technology sector showed resilience with continued investor interest in IT services and digital solutions.

- Banking: HDFC Bank and SBI were among the top performers, bolstered by positive financial results and growth expectations.

- Energy: Reliance Industries’ strong performance uplifted the energy sector, supported by its diversified business model and strategic investments.

Market Sentiment

Investor sentiment remained optimistic throughout the day, driven by favorable economic indicators and corporate earnings reports. The market’s positive performance was also influenced by global cues and stable macroeconomic conditions.

Key Developments

Several key developments influenced market activity:

- Monetary Policy: The Reserve Bank of India’s (RBI) recent policy decisions aimed at maintaining economic stability played a crucial role in boosting investor confidence.

- Global Markets: Positive trends in global markets, especially in the US and Europe, provided additional support to Indian equities.

- Corporate Announcements: Strong earnings reports and strategic announcements from major companies like Reliance Industries and HDFC Bank contributed to market gains.

Technical Analysis

From a technical perspective, the Sensex demonstrated strong support at the 76,000 level, with resistance around 77,000 points. The day’s movement indicates a bullish trend, with potential for further gains if positive momentum continues.

Future Outlook

Analysts remain cautiously optimistic about the near-term outlook for the Sensex, citing strong corporate earnings, favorable economic policies, and global market trends as key factors. However, they also advise investors to stay vigilant about potential risks, including geopolitical tensions and economic fluctuations.

Conclusion

The Sensex’s performance on June 10, 2024, reflects robust market conditions and investor confidence. With significant gains across major sectors and positive economic indicators, the market appears poised for continued growth. Investors are advised to stay informed and consider both opportunities and risks in their investment strategies.